In the middle of a crypto attack today, only one crypto made the biggest gain: Maker (MKR).

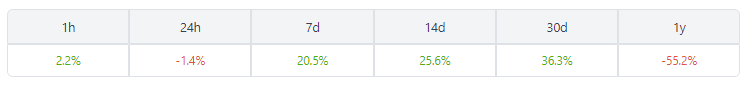

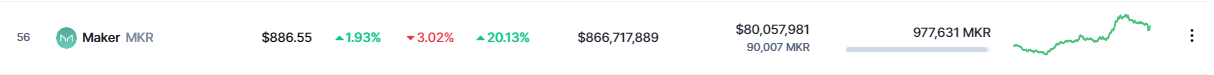

At the time of writing, MKR was trading at $896, notching an impressive 21% increase in the weekly scale, and outperforming the rest of its rivals in the top 100 list of crypto market trackers Coingecko and CoinMarketCap.

Maker (MKR) Stands Out With Solid Gains

Source: Coingecko

MKR is up 35% in the last 30 days and 76% year to date, data shows. However, the token, with a market cap of $873.6 million, was still down nearly 85% from its all-time high (ATH) of almost $6,300, hit about two years ago in May 2021.

Source: Coingecko

Although the chip fluctuated laterally between $760 and $800 in the early morning hours, It burst from its narrow reach as soon as the sun came up. After that, mkr skyrocketed through the phases and hit $920 on top.

Source: CoinMarketCap

MKR is the utility token of the Maker protocol, which also serves as the system’s governance token and recapitalization resource. The mkr tokens that cannot be redeemed are generated according to demand and supply.

Mkr token holders administrating the project through makerdao, an open-source community project on blockchain ethereum and an autonomous decentralized organization.

Maker (MKR). Image: The Coin Republic

Maker (MKR) is among the most significant decentralized apps (dApps) on the Ethereum blockchain. It was also the first decentralized financial application (challenge) to gain popularity across the board.

The aim of the platform is to unlock the challenge potential through an inclusive platform for economic empowerment, i.e, giving everybody equal access to financial markets around the world.

Worry Surrounds Borrowing Of DAI

Meanwhile, a prospective change to one of DeFi’s oldest and largest protocols has the crypto community concerned.

An element of makerdao's proposed reconfiguration would allow users to borrow its stability in return for its mkr governance token.

Market observers worry that allowing users to borrow stablecoin for mkr can be compared to the mechanism underlying the unhappy stablecoin (luna), that crashed in May 2022 and took approximately US$500 billion out of the crypto marketplace.

MKR total market cap at $877 million on the daily chart | Chart: TradingView.comPaperImperium, a "liaison of governance", tweeted:

"It's terribly disappointing to see the co-founder of Maker pushing this plan [...] it's as though nothing had been learned this cycle."

It’s devastatingly disappointing to see @MakerDAO’s co-founder pushing this plan. It’s as if nothing was learned this cycle. pic.twitter.com/XQq8NydHqb

— PaperImperium (@ImperiumPaper) February 23, 2023

USDT Mkt Cap + BUSD Mkt Cap + USDC Mkt Cap + DAI Mkt Cap + FRAX Mkt Cap, Source: The Defiant TerminalThe Defiant Terminal class DAI as the fourth largest stabilizer with a $4.1 billion market valuation on Ethereum.

According to paperimperium, the delegated tokens would be put back into circulation in the event of a winding-up spiral, pulling the mkr value down.

As a result, this could make the protocol a sitting duck from malevolent actors who can quickly seize control over governance, as demonstrated by the Mango DAO attack.

-Featured image from Rare Gallery

BlocksInform

BlocksInform