Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week.

2023 began on an upward note for the crypto market as a whole, including the challenge ecosystem, with most tokens posting double-digit wins in January and recording multi-year highs. In addition to the uptrend, the month of January also saw a 93% decrease in losses compared to the previous year due to challenges and piracy.

The series of regulatory measures against the mango market operator is hailed as a great victory for the challenging industry. The U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) took action against the alleged perpetrator, This demonstrates that challenge is becoming a "safer and more welcoming environment", says Moody's.

In spite of all the positive developments, the Solana Challenge Everlend protocol closed due to liquidity problems related to the FTX crisis and asked users to withdraw funds. The North Korean pirates also attempted to launder 27 million dollars in aether () from the Harmony Bridge attack.

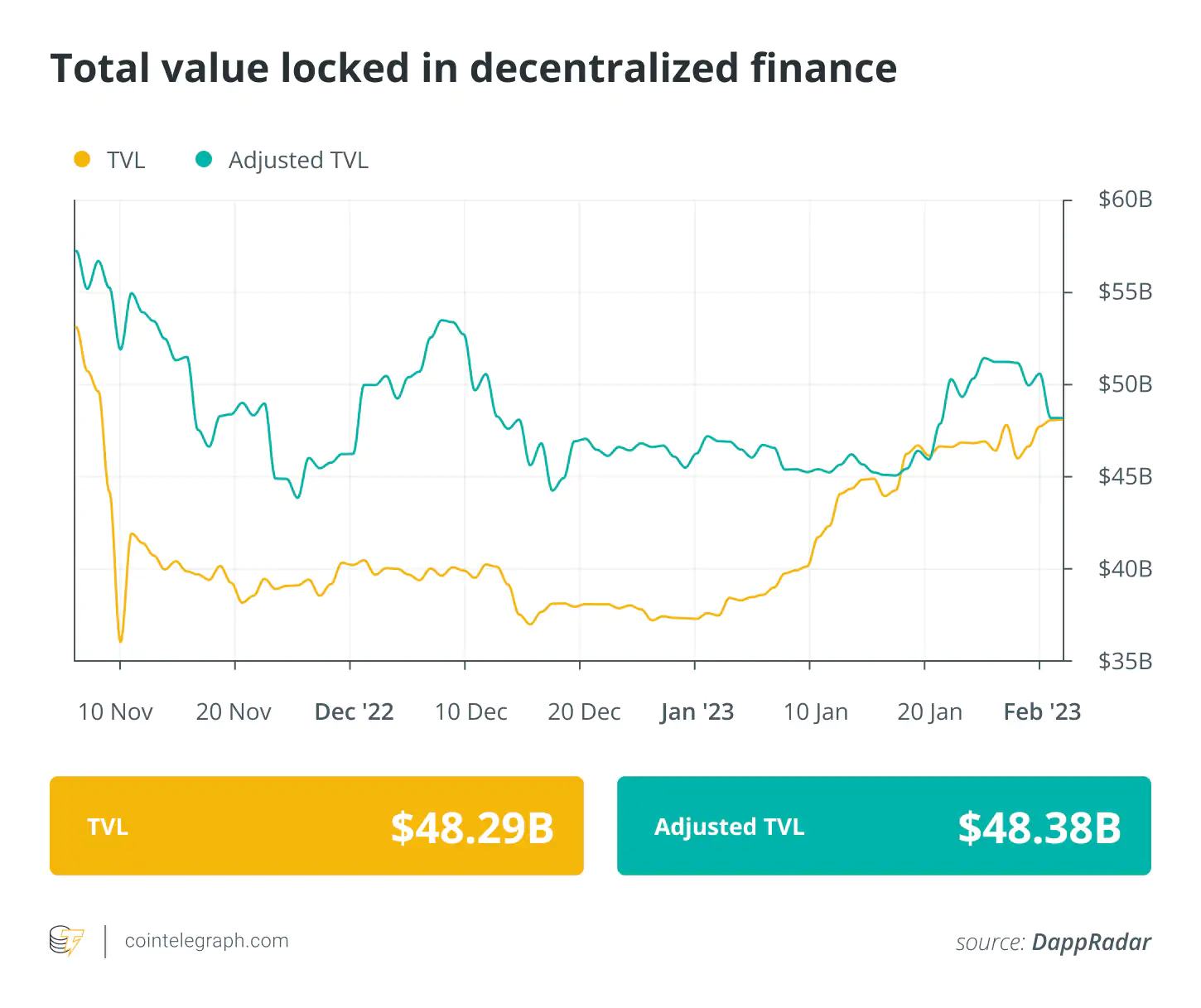

The upward momentum of the 100 largest challenge tokens continued in February as the total locked-in value (tvl) in challenge protocols reached close to $50 billion, with the majority of tokens registering a new weekly price increase.

DeFi enjoys prolific start to 2023: DappRadar

DeFi protocols boomed in TVL through various staking groups in January. The market reached $74.6 billion in staked assets, up 26% year-on-year.

In his latest monthly report, dappradar described the growth of the challenging sector alongside rejuvenated (nft) non fungible token markets, which also experienced volume and sales gains.

Crypto exploit losses in January see nearly 93% year-on-year decline

Aside from the upward rally in the cryptocurrency market in January, there was more positive news in the industry as the month experienced a sharp decline in exploit losses from January 2022.

According to the data of the blockchain security company, peckshield, in January 31, there were 8.8 million dollars in crypto exploits losses. There were 24 exploits over the month, with $2.6 million worth of crypto sent to mixers such as Tornado Cash. The breakdown of assets sent to mixers includes 1,200 ETH and approximately 2,668 BNB.

Regulatory action against Mango Markets exploiter is a win for DeFi — Moody’s

Recent charges brought against Mango Markets exploiter Avraham Eisenberg will positively impact the DeFi space, according to credit rating firm Moody’s.

A note from Moody's Investor Service dated January 31st, Assistant Deputy Chairman, Decentralized Finance, Cristiano Ventricelli, said the enforcement actions taken by the two major U.S. market regulators in January mean that the challenge is shifting to a "safer and more welcoming environment."

Solana DeFi protocol Everlend shuts down over liquidity issues

Protocol Solana Challenge Everlend closes its operations and urges its customers to remove funds from the platform.

The company made the announcement on twitter on Feb. 1, affirming that in spite of having "enough track" to continue to operate, this would be a bet under current market conditions.

North Korean hackers try to launder $27M in ETH from Harmony bridge attack

North Korean exploiters behind the Harmony bridge attack continue to try and launder the funds stolen in June 2022. According to January's chain data. 28 by Blockchain Sleuth, Zachxbt, the authors moved 17,278 eth during the weekend, valued at approximately 27 million dollars.

The tokens were transferred to six crypto exchanges, zachxbt tweeted, without divulging which platforms had received the tokens. 3 main addresses performed the operations.

DeFi market overview

The analytical data show that the total value of the challenge contract remained in excess of $40 billion last week, trading at approximately $48.1 billion at the time of writing. Data from Cointelegraph Markets Pro and TradingView show that the top 100 challenge tokens per market cap had an optimistic week, with almost all tokens recording price wins.

dYdX (DYDX) was the biggest gainer again, with a 39% surge on the weekly charts, followed by Fantom (FTM), which continued last week’s bullish momentum and registered a 33% weekly surge.

Thank you for reading our highlights from this week. Please join us on Friday to learn about this evolving space.

BlocksInform

BlocksInform