Investors in the crypto market are looking for more than just an eye-catching product. Although small-capitalized cryptocurrencies may seem tempting, they are not necessarily good investments.

The real issue for prospective buyers is to know what the token is for. It is not enough to have an innovative and well-designed product – there must be a clear objective to purchase and preserve the piece.

Crypto investors Real usefulness research.

While the crypto market continues to grow and mature, investors are increasingly sophisticated and judicious in their choices. They are looking for projects with real token utility – something that they can actually use and benefit from in their daily lives.

This shift in focus has prompted businesses to re-evaluate their token's role in their ecosystem, as cryptocurrency investors want to know what they are buying. In response, many businesses now think creatively and critically about the value their token has to offer.

Some companies are even exploring new instances of token usage, such as user engagement incentives or access to proprietary services.

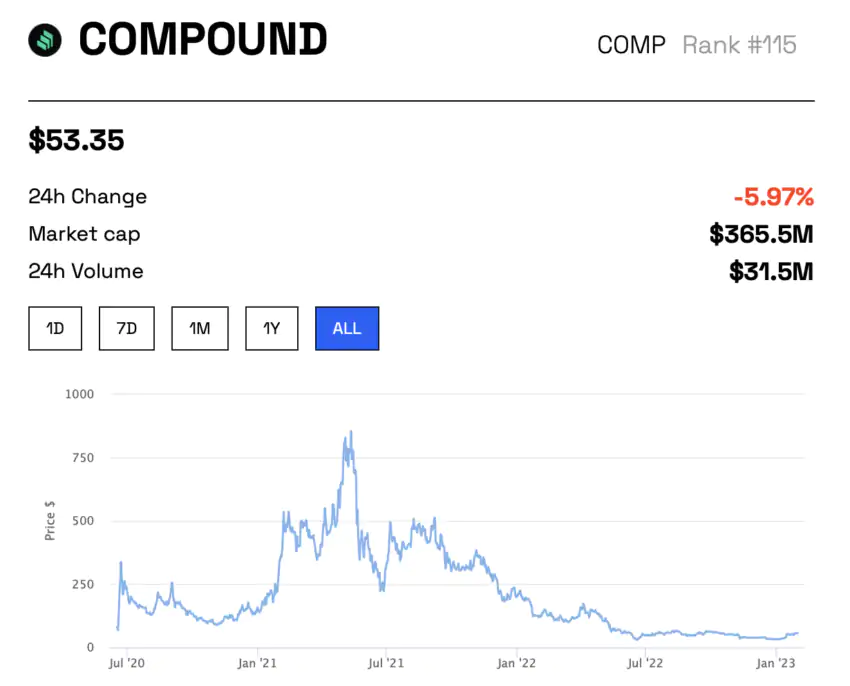

An example of a business that has managed to take advantage of the token utility is made up, a decentralized funding platform (). Compound token is used for voting on protocol changes, providing cash, and winning rewards. This led to strong demand for the token and increased its market capitalization from $0 billion to $1 billion in one year alone.

Another example is Chainlink, a decentralized network that connects smart contracts to real-world data. Its native token, LINK, is used to pay for services on the network and incentivizes node operators to provide accurate data. As a result, the chain has become one of the most widely used decentralized oracle platforms in the blockchain industry.

Despite increasing interest in symbolic utility, not all businesses have been able to provide real value. Many coins are still regarded as speculative investments, with no specific purpose or underlying value.

High risk in small capitalization chips.

Investing in low-capitalized, meaningless cryptocurrencies can be a risky proposition. The utility of a token refers to the purpose and utility of the token within the ecosystem in which it operates. In the cryptocurrency world, the market capitalization of a token depends to a large extent on its perceived value, which is derived from its usefulness.

Cryptographic investors should take into account the object and use case of the token. Small-cap tokens with no real value may not be supported by tangible assets or have intrinsic value. As a result, these chips are prone to wild price fluctuations, and their value can drop rapidly and without notice.

BlocksInform

BlocksInform