So, let’s dive in and look at the second part of the CoinGecko report. Below is a video of the report, presented by CoinGecko’s Head of Research, Zongh Yang Chan. After his presentation, you can see a panel discussion led by Bobby Yong. He’s CoinGecko’s COO and co-founder.

faced quite a few challenges in 2022. This was mainly due to the collapse of Terra/Luna and FTX. Terra alone was responsible for wiping out billions of Dollars throughout the ecosystem. On the other hand, the FTX scenario also sent people over to DeFi. You can swap and trade on DeFi and keep control over your assets. Still, overall, DeFi lost 77.3% in market cap during the year. In TVL, there was a similar loss of 73.2%.

DeFi yields also took a hit. From a 14.60% high, it went down to 2.89% for holding stablecoins. Now the US 1 year T-bill rates are even higher at 4.47%. That’s the Fed hiking rates to battle inflation.

Despite the loss in TVL, Ethereum still rules TVL with a 60% stake. However, BSC and Tron managed to increase their market share throughout the year. Furthermore, also the DeFi tokens market couldn’t keep up. They lost 72.9%. We also see a new trend that derivatives surpassed yield aggregators. Especially GMC and Gains Network did well in this field.

Source: CoinGecko 2022 Annual Crypto Industry

To keep this downward trend going, DeFi bridges lost $8.03 billion in liquidity. That’s 69.3%. Bridges were also a prime target for hackers. Nomad, Harmony, and the BNB Bridge totaled some $1.9 billion in exploits.

Still, DeFi also saw some positive action. There was a lot of buidling going on. Decentralized perpetuals are in the rise. GMX leads this charge. Cross-chain bridges evolved, and protocols showed their V3s! For example, Aave V3 and Bancor V3. The chart below shows the market cap decline of DeFi on 2022.

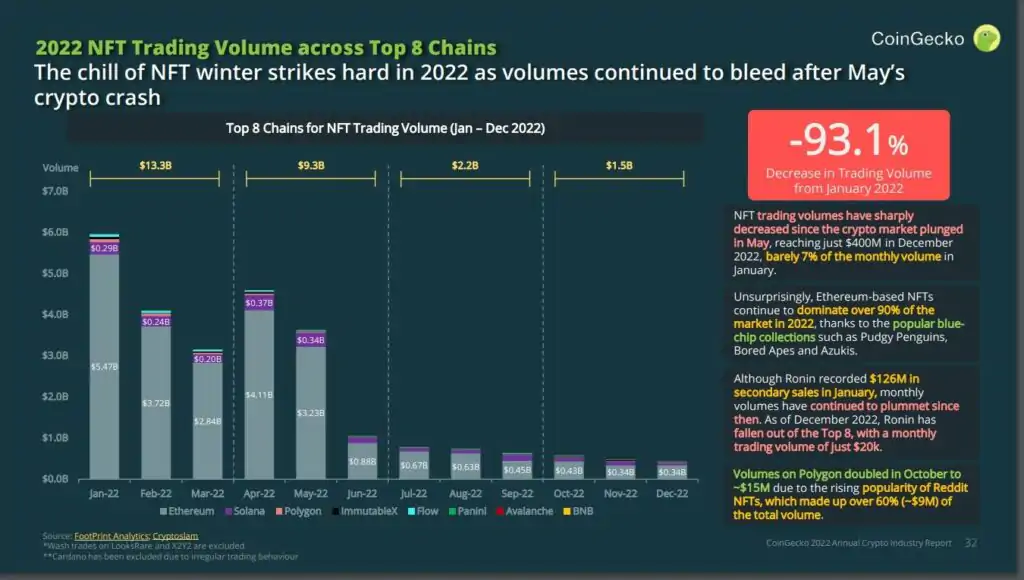

have taken the hardest hit of all crypto related sectors. January 2022 was a peak month, but decline started straight after. Since January 2022, the NFT market lost 93.1% in trading volume. After the Terra/Luna related crypto crash in May, the NFT market started to suffer even more. From $6 billion in January to $1 billion in June. This decreased even more to only $400 million in December.

However, Ethereum remains the dominant NFT chain with 90% of the market share. They have the most popular collections with CryptoPunks, BAYC, Azukis, and Pudgy Penguins. Still, even after the Ethereum Merge, gas fees are still high. Most other chains have much cheaper fees. On buying a $15 NFT on Ethereum, gas can be anywhere between $5 and $11. On the other hand, on and other chains, the gas fees are a fraction of a cent.

Notable is Polygon in November when their volume doubled in October. That’s due to the popularity of Reddit NFTs. That was 60% of the total volume during that month.

NFT Marketplaces

OpenSea is still the dominant NFT marketplace in this first NFT crypto winter. They still have 65.4% of trading volume at the end of the year. However, we must point out that this includes Ethereum, Polygon, and Solana. Magic Eden came up on the Solana chain. They got some of OpenSea’s volume. There’s also been a decline in creator royalties. Not only because of declining sales, but also because of marketplace policies.

GameFi is on the rise, though. P2E has lost its appeal, for now. However, other forms of GameFi are stepping up. For example, Stepn with the Move-2-Eran movement. One of the top games outside of Ethereum is Gods Unchained on Immutable X, with 10,000 daily players. Below shows the NFT trading volume chart for 2022.

Exchanges

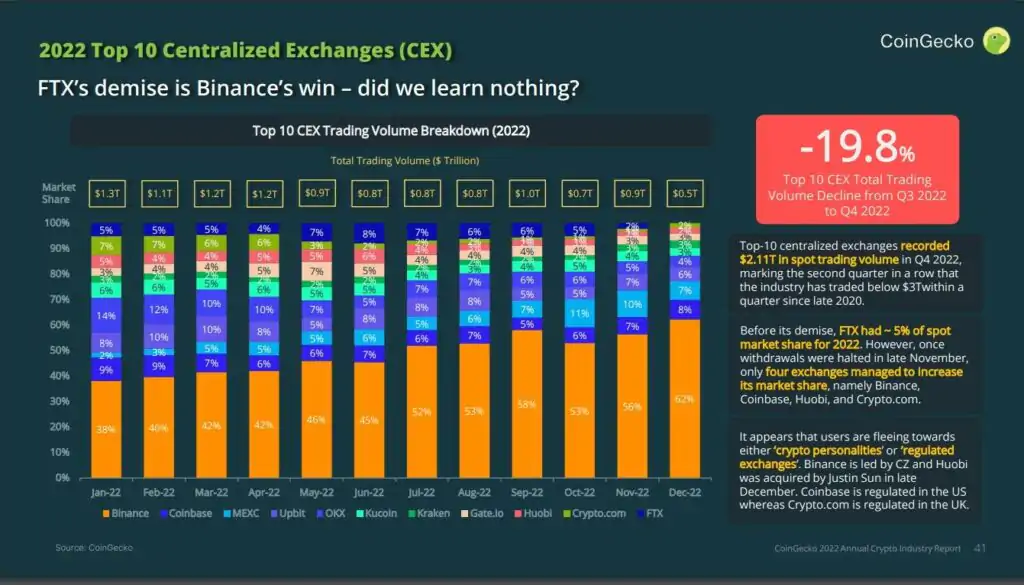

Looking at the exchanges, centralized exchanges (CEXs) are still dominate with 92.5% of the market over DEXes. The November FUD over Binance, gave DEXes a small boost. However, this was not enough to make a serious dent in the CEXes dominance.

After the FTX collapse, Binance’s dominance only increased. They now have an almost 62% dominance in spot trading of the total market. The biggest decline in CEXes trading volume was during Q4-2022, after the FTX collapse in November. That was 21.2%.

For the DEXes space, Uniswap remains the leader of the pack. However, Q4-2022 also saw here the biggest trading volume loss, by 14.6%. This figure comes from the 10 biggest DEXes. The picture below shows the BINANCE dominance over 2022 for CEXes.

This is Part 2 of 2 articles that covers the CoinGecko 2022 Annual Crypto Industry Report. For a link to Part 1, look at the top of this article.

BlocksInform

BlocksInform