BNB Chaindecentralized protocol LaunchZone loses $700,000 as attackers drain liquidity from the protocol using the PancakeSwapPancakeSwap, the most used decentralized application on the BSC network, is famous for its token launches, as well as for its many different features. The DEX makes trading extremely accessible, even for those new to the DeFi scene. Here is...Know more decentralized exchange at about 7:32 a.m. UTC on Feb. 27, 2023.

The LaunchZone team later trading of its native token, LZ, which has since fallen 83% to about $0.000086.

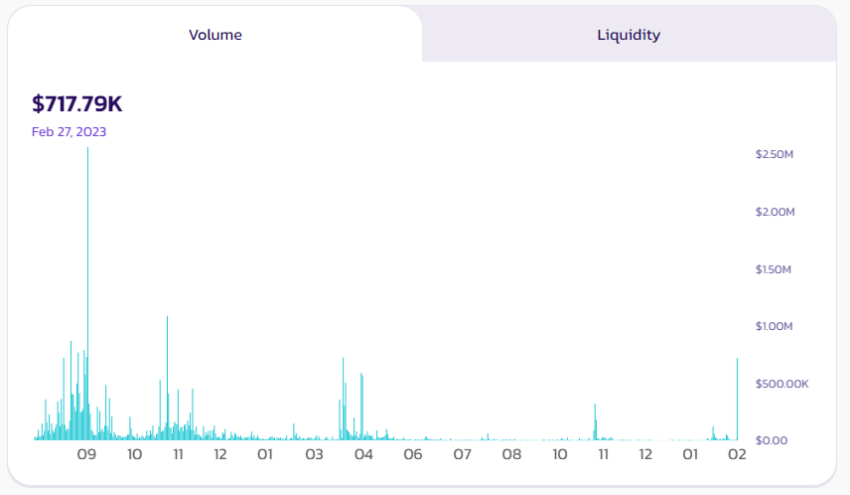

BNB Chain DEX PancakeSwap Shows Spike in Trading Volume of LZ/BUSD Pair

Following the announcement, Biswap, a decentralized exchange on the BNB chain, said it would delist the token in five hours.

Dear Biswappers,

token will be delisted within 5 hours due to its hack by the DND exploiter.

??Please, don’t make any transactions at this stage??

@launchzoneann team is handling the situation.

Stay safe with @Biswap_Dexpic.twitter.com/sDesj4B8za

— Biswap (@Biswap_Dex) February 27, 2023

LZ is a governance and utility token of the LaunchZone ecosystem that conforms with the Despite originating from crypto-hostile China, BINANCE has managed to become the world's largest cryptocurrency exchange, serving over 13.5 million active users. Now headquartered in the Cayman Islands, Binance's mission has been to offer a full suite of crypto trading services....Know more token standard. The token has a total supply of 50,000,000. According to Coingecko, it is traded mostly on PancakeSwap, another BNB DEX.

Currently, the LZ/BUSD trading pair on PancakeSwap DEX has the highest liquidity. It’s transaction volume was up over 7,000% in the last 24 hours to over $700,000, suggesting that it may have been used in the exploit.

Analytics firm Chainalysis recently reported that Decentralized Finance (DeFi) are financial services built on blockchain technology. It seeks to empower the populace by creating an open, efficient, and all-inclusive financial system. Using smart contracts, DeFi platforms provide permissionless finance, thus enabling financial inclusion for all. DeFi...Know more exploiters stole over $3 billion in 2022, accounting for 82% of all crypto attacks. Exploits targeted smart contracts that users used to transfer cryptocurrencies from one blockchain to another, called bridges.

The COO of Halborn, a What is it that makes the Ethereum network such a popular choice for decentralized finance (DeFi)? Decentralized Finance (DeFi) is a term that is being used to describe the world of financial services that are increasingly being offered through decentralized...Know more smart contract auditor, said that many DeFi protocols suffer attacks because they don’t invest enough in securityThere are many benefits of Bitcoin, one of many is the unprecedented freedom which it provides from banks through its technology. This is a revolutionary idea, no more banks needed. Here you'll find all the basic crypto security tips you...Know more personnel.

“A big protocol should have 10 to 15 people on the security team, each with a specific area of expertise,” he told Chainalysis in the firm’s 2022 crypto hacking report. “The DeFi community generally isn’t demanding better security — they want to go to protocols with high yields. But those incentives lead to trouble down the road.”

Earlier this month, quant trading firm Jump Crypto security flaw in Binance’s BNB Chain that would have allowed the minting of an unlimited number of the exchange’s BNB tokens. The BNB Chain team reportedly resolved the issue within 24 hours.

Texas Regulators Block Binance.US Acquisition of Voyager Assets

In other There are many cryptocurrency exchanges and wallets that provide great features for trading and investment, but one of the main platforms is Binance. Founded by Changpeng Zhao, a developer who built a number of different investment tools, the platform has...Know more news, Texas regulators filed court papers last week to block Binance.US’s acquisition of the assets of bankrupt crypto broker Voyager Digital.

In a joint with the New Jersey Bureau of Securities on Feb. 24, 2023, Texas regulators said that, despite the Binance deal having significant support from Voyager’s unsecured creditors, the creditors were not made aware of Alameda’s $446 million clawback claim, which could reduce the claims of other creditors from 51% to 25%.

The U.S. Securities and Exchange Commission recently court papers alleging that Binance.US potentially faces business risks from regulatory actions, making transferring of customer assets from Voyager to Binance.US untenable.

A U.S. judge of the Southern District of New York bankruptcy court approved Binance.US’s acquisition of Voyager’s assets for $1.02 billion in Jan. 2023.

Voyager Digital filed for bankruptcy in July 2022 after bankrupt hedge fund Three Arrows Capital failed to repay a $654 million loan.

BlocksInform

BlocksInform