Providing access to financial services to everyone is one of the primary goals of the cryptocurrency industry. The first step in making this a possibility is the development of decentralized exchanges. DEXs allow anyone with an internet connection and a crypto wallet to buy and sell digital assets. Read on to learn what decentralized exchanges are and discover the top decentralized exchanges on the market today.

- What are decentralized exchanges?

- What are the different types of decentralized exchange?

- Which is the best decentralized exchange (DEX)?

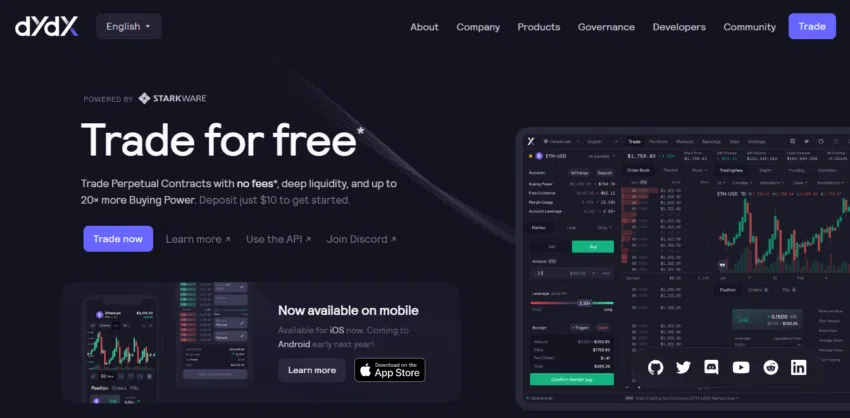

- 1. dYdX

- 2. ApeX PRO

- 3. Uniswap

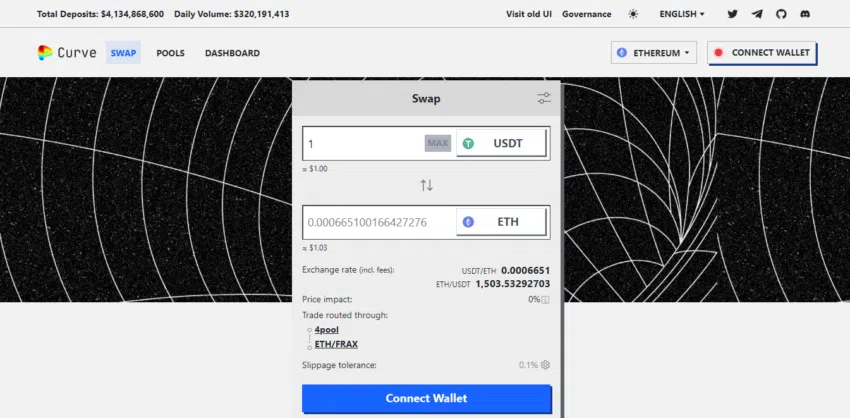

- 4. Curve

- 5. Balancer

- 6. PancakeSwap

- 7. SushiSwap

- 8. Bancor

- 9. DODO

- Decentralized exchanges are here to stay

- Frequently asked questions

What are decentralized exchanges?

Decentralized exchanges are online trading platforms built on open blockchains that allow for the buying and selling of cryptocurrencies without the need for an intermediary or third party such as a bank.

A decentralized exchange differs from a traditional stock exchange or a centralized cryptocurrency exchange. With a DEX, users hold power to make decisions regarding the platform. Services are distributed amongst users rather than held by a central authority. This kind of power distribution aligns decentralized exchanges with the principle of cryptocurrencies, which aim to promote decentralization and financial sovereignty above all.

Further, decentralized crypto exchanges are more resilient and more private than traditional finance and centralized exchanges. Users are not required to reveal their identity through a Know Your Customer (KYC) process. Instead, they only need to connect their crypto wallets, look for the crypto they want, and initiate trades.

Decentralized exchanges mimic the principle of crypto and financial sovereignty in their operations. They also use the technology upon which crypto is built. All DEXes are built on public blockchains.All utilize different aspects of blockchain technology, like smart contracts, tokens, and layers. However, each decentralized exchange differs from another based on its individual features. This varies from the code used to build the DEX to how users interact with the platform.

What are the different types of decentralized exchange?

In terms of functionality and price determination, there are currently three main types of decentralized exchanges.

- The first and most common ones are Automated Market Makers (AMMs), which utilize algorithms to determine crypto asset prices in real-time. Peculiar about them is the fact that they have no order book that is known from traditional exchanges.

- Next are DEXs that use on-chain order books. These types of exchanges record all possible trades for a particular crypto asset on an order book. The interaction of willing buyers and sellers on the exchange’s order book determines the market price of the assets. Further, the trading information on an on-chain order book DEX is recorded on the blockchain, but assets remain off-chain in user wallets.

- Another type of DEX utilizes off-chain order books. Most of the time, this implies going against the use of blockchain, which means that some off-chain order books decentralized exchanges use a centralized authority instead when processing transactions. Then after the transactions are recorded in the order book, the actual asset transaction is settled on-chain, which means a blockchain is used for settlement but not for clearing trades.

Lastly, we have so-called DEX aggregators. These decentralized exchanges increase liquidity and trading options for their users by compiling data from different DEXes in real time. In this case, traders don’t have to compare data from different platforms but instead can access all information in one place, thereby getting the best price execution.

Which is the best decentralized exchange (DEX)?

Platform | Best Feature | |||

dYdX | Sign-up | Free monthly trading option | No fees for deposits or withdrawals. Perpetual trades are free for everyone, up to $100,000 every month. | ETH, BTC, , AVAX, , MKR, , ZRX, , UNI, , SNX, , ALGO, LINK, DOT, XMR, ZEC, DOGE, ADA, BCH, | No bonus for new users |

APEX Pro | Sign-up | Trade-to-earn activity |

| BANA, USDC, BTC, ETH, , CATOM, and DOGE | Regular activities with airdrops, bonuses and rewards for users |

Uniswap | Sign-up | Adequate liquidity on many trading pairs | 0.3% fee for swapping tokens | ERC-20 tokens | |

Sign-up | Yield farming | o.o4% trading fee | ERC-20 stablecoins, , ETH, FRAX, AVAX, multiple asset support | |

Balancer | Sign-up | Versatile automated market maker | Pool fees are between 0.0001% to 10% | ERC-20 tokens | |

PancakeSwapSign-up | Low transactions cost | 0.25% trading fees | tokens | |

SushiswapSign-up | Staking and farming | 0.3% trading fees | ||

Bancor | Sign-up | Impermanent loss protection | No trading or withdrawal fees from the Bancor protocol itself, each pool is set with a specific trading fee paid to the liquidity provider | ||

DODO | Sign-up | Smart trade | 0.3% transaction fee | ERC-20 and EVM compatible chain tokens |

Heading up our list is , a completely decentralized exchange. Users can participate in margin and perpetual trading. The exchange is built on StarkEx, an Ethereum layer-2 solution. The DEX utilizes zero-knowledge-proof technology to ensure decentralization, privacy, and security

On top of the already low commissions, token holders can enjoy even more discounts on their trades. However, the exchange recently announced plans to move its function onto its own blockchain in the Ecosystem. This will increase speed, customizability, and trading flow. The fourth version of the DEX will implement this change.

Despite the impending move to another chain, the DEX will continue using order books and matching models in its trading function. It will also maintain the use of the exchange’s native token and Hedgies, the platform’s NFTs. Both tokens have governance functions. And both work as incentivization schemes for users utilizing the exchange.

- Clear interface

- Quick transactions

- Large selection of popular types of trading orders.

- A limited selection of margin trading

- A limited selection of swaps

ApeX PRO

Next on our list is ApeX Pro, a non-custodial crypto exchange that offers traders access to derivatives crypto trading, specifically perpetual futures contracts, by utilizing the platforms’ scalability engine, StarkEx, an Ethereum layer-2 solution.

ApeX users benefit from a no-KYC registration process, which lets them keep a high degree of privacy when trading. Further, the platform offers zero gas fees for trading. It gives leverage and minimal slippage to users via its order book mechanism.

The DEX is multi-chain, making trading tokens from Ethereum, ERC-20, and other tokens from EVM-compatible chains possible. Lastly, the platform has two main tokens, APEX and BANA. The platform uses APEX for governance and user incentivization, while BANA is a reward token in the ApeX Pro ecosystem.

- Leverage up to 20x.

- Mobile App iOS/Android: ApeX Pro

- Testnet – demo trading account with no risk

- The possibility of decentralized trading in perpetual contracts for top cryptocurrencies.

- Limited choice of trading instruments

Uniswap

Third on our list is Uniswap, the biggest decentralized exchange in terms of trading volumes. The platform facilitates crypto trading while utilizing the power of automated market-making in its trade functions and price determination.

Originally built on the Ethereum blockchain, the platform has since moved to other blockchain ecosystems and layer-2s. It is compatible with ERC-20 tokens. Uniswap runs using two smart contracts. The first is the exchange contract, which facilitates token swaps. The second is the factory contract, used when adding new tokens to the platform.

Uniswap is unique as it allows anyone to add new tokens to the platform. It also enables developers to utilize its open-source code to create their own decentralized exchange. Furthermore, Uniswap allows its users to make governance decisions using the platform’s native token, UNI. Each UNI holder can vote on changes and additions to the platform.

- Adequate liquidity

- No registrations

- Friendly UX

- Gas fees

- High-risk of scam tokens

Another automated market maker decentralized exchange you should know about is Curve. Curve mainly specializes in the trade of stablecoins.

Curve, originally built on the Ethereum blockchain, provides extra perks to its users. One of these perks is the ability to use whatever you have invested in the Curve platform on other apps in the ecosystem. A function called composability.

Also, the platform uses CRV, its native token, for governance and as an incentive vehicle for its users. Users can buy or earn CRV through yield farming. When users deposit assets into a liquidity pool, they are rewarded with CRV tokens.

- Low fees

- Non-custodial

- Many liquidity pools

- Not very beginner friendly

- If there is an issue with a linked DeFi pool, Curve pools might be affected

5. Balancer

Next on the list is Balancer, a DEX that allows users to trade cryptocurrencies and acts as a liquidity provider platform and an automated portfolio manager.

Balancer was originally built on the Ethereum blockchain. The DEX uses the automated market-making mechanism to establish prices. The platform has two faces, an exchange for traders and an investment fund. This fund allows liquidity providers to own a piece of the platform, should they choose.

Just like other AMM-based DEXs, Balancer has liquidity pools. Here, people can deposit their crypto assets and help manage the ecosystem, especially the price. Furthermore, the users play an active role in making decisions in Balancer. This is done by using the platform’s native token, BAL, which exists to enable platform governance.

- Custom automated market makers

- Multi-asset pools

- High risk of scam tokens

- Not very user friendly

6. PancakeSwap

This popular DEX runs on the BNB Chain. PancakeSwap utilizes the AMM model to make decentralized cryptocurrency trading possible. At the same time, liquidity providers can deposit their crypto assets into liquidity pools, thereby creating liquidity for the DEX.

In addition to traditional crypto trading and buying, PancakeSwap gives its users access to additional services. Pancake users can take part in yield farming, staking, and trading NFTs. They can also access other features of the platform, like Initial Farm Offerings (IFOs), PancakeSwap Lotteries, Prediction Markets, and Syrup Pools.

Users on the platform also have the right to vote on decisions related to the exchange platform. They do this using , the platform’s native token.

- Low slippage

- Low transaction costs

- High transaction volume

- Network congestion

- High-risk for scam tokens

SushiSwap

Another decentralized exchange hosted across multiple chains is SushiSwap. SushiSwap was created as a clone of UniSwap. To this day, UniSwap has an open-source code that lets anyone use the code to create their own DEX. The original founders behind SushiSwap made use of this, copying and implementing the UniSwap code to start SushiSwap.

Regardless of using UniSwap’s code, the platform has unique features like a liquidity mining offering that attracts its own liquidity providers. It also lets its users take part in governance decisions through the platform’s native token, SUSHI.

Initially built on the Ethereum blockchain, SushiSwap is currently present on 14 other chains. These include Polygon, Arbitrium, Moonbeam, Optimism, and Avalanche

The Bancor protocol is a decentralized exchange platform that allows for the instant conversion of crypto assets. It operates on the Ethereum blockchain and uses the AMM model.

Unlike other DEXs, Bancor looks to provide returns to liquidity providers, even small and micro-cap coins. That way, the DEX hopes to provide access to many other cryptocurrencies that may be inaccessible through other decentralized exchanges.

Just like other DEXs though, Bancor embraces the rule of community governance. It does this through the platform’s governance token, which enables users to vote on decisions. Otherimportant tokens to the platform include BNT, the platform’s native reserve currency. ETHBNT, a token that represents shares of BNT and ETH in Bancor/Ethereum pools, is also a popular token on Bancor.

- Impermanent loss protection

- Supports numerous tokens

- Single-sided deposits

- Third-party centralized trading platforms

- Not very user-friendly

Introducing DODO, a cryptocurrency exchange built on Ethereum and BNB Chain. Its unique algorithm is known as the ‘Proactive Market Maker Algorithm.’ The algorithm is used to provide better price finding and liquidity when compared to other AMMs. The algorithm also facilitates easy market entry for small projects like newly minted assets.

DODO also has a key feature called SmartTrade. This enables a decentralized liquidity aggregation service that routes to and compares liquidity sources to quote the optimal swap rate for trading tokens. Another unique feature of the platform is Crowdpooling. Here, liquidity markets are available, allowing projects to distribute tokens equally without interference from bots. The pooling feature also allows users to create their own market-making strategies.

Users of DODO can vote on governance issues using the platform’s native token, also called DODO

- Low transaction fees

- Highly accurate pricing

- No minimum deposit for liquidity providers

- Impermanent loss protection

- Adoption and TVL continue to drop

Decentralized exchanges are here to stay

Decentralized exchanges promise more autonomy and security than centralized exchanges. With 2022 demonstrating the inherent weaknesses in CEXs (namely, their centralization), decentralized exchanges will likely only become more prominent in years to come. Yet, as with any other innovation in the crypto space, users need to research any DEX before trading. As a rule of thumb, make sure to invest only what you are willing to lose. Only trade on decentralized trading venues with code audited by third-party smart contract auditors.

Frequently asked questions

How are DEXes really decentralized?

DEXes are decentralized in two main ways. The first is through the use of an open-source, decentralized blockchain as its core settlement infrastructure. All information about transactions is available to the public here. At the same time, DEX exchanges maintain user privacy by eliminating burdensome and restrictive Know Your Customer procedures. Secondly, DEXs shift the power of decision-making from a central authority to the users. They do this by enabling users to vote on issues using a platform’s own governance token.

What is the difference between DEX platforms and DeFi platforms?

DEX platforms can be categorized as DeFi Platforms. This is because they perform some of the functions (buying, exchanging, and earning) that DeFi platforms are known for. More generally, DeFi platforms are decentralized applications (DApps) created to enable access to peer-to-peer transactions on a blockchain. In a sense, DEXs are a subcategory within the broader category that is DeFi platforms.

Are DEX sites safe to use?

Just like any other crypto platform, DEX sites are vulnerable to attacks from malicious individuals or groups. Users are encouraged to use appropriate safety mechanisms when accessing and trading on any DEX sites. Since DEX sites are governed by the community, they can be vulnerable to attacks. As an investor, you are solely responsible for the safety of your crypto assets. It is best to only trade on reputable DEXes that have had their code audited to reduce chances of losing funds due to a hack or a bug in the code.

BlocksInform

BlocksInform